TALLAHASSEE, Fla. (WFLA) — As Floridians look forward to the governor to log off on the state price range, they’ve additionally been left questioning concerning the well-liked hurricane tax vacation. This yr, a serious change occurred on the statehouse that reshaped the best way residents save on storm prep.

The state’s longtime hurricane gross sales tax vacation is gone. As an alternative, lawmakers authorised a year-round tax break on key storm provides.

“It’s now not a couple of week or two weeks the place you should purchase a generator and have the exemption of a gross sales tax that is going to be year-round,” stated Home Speaker Danny Perez (R-Miami).

So, will Floridians save massive on hurricane prep this yr? It relies on what you need to purchase.

If you happen to’re stocking up on the big-ticket objects like moveable turbines, tarps, fireplace extinguishers, tie-down kits or family batteries, you are in luck. However in the event you’re eyeing flashlights, energy banks, climate radios, or lanterns, no low cost for you.

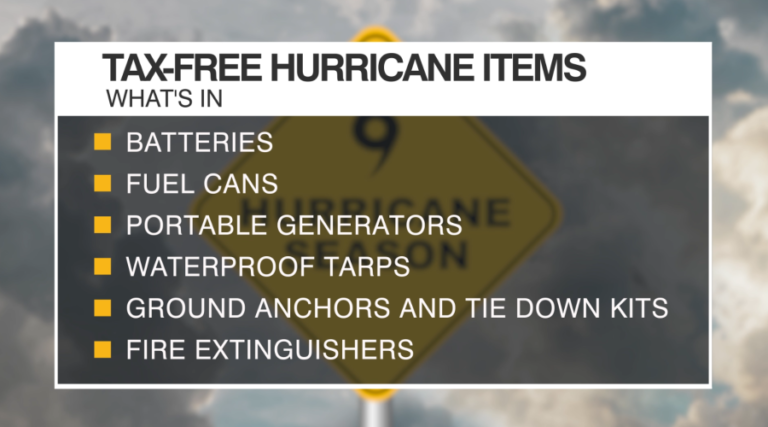

What’s in:

- Family Batteries

- Gas Tanks

- Moveable Turbines ($3000 or much less)

- Tarps

- Floor anchors

- Tie-down kits

- Bottled water (already tax-free)

- First support Kits (already tax-free)

- Most non-perishable meals objects (already tax-free)

- Fireplace Extinguishers

- Smoke detectors

- Carbon Monoxide Detectors

- Sunscreen

- Insect Repellent

What’s out: objects which might be much less particular to catastrophe response

- Reusable ice packs

- Lanterns

- Flashlights

- Candles

- Moveable energy banks

- Climate radios

“A number of individuals which might be shifting to Florida which have by no means been via a storm,” stated Senate President Ben Albritton (R-Wauchula). “We’re telling Floridians, we hear you, we see you, and we’re enhancing that, we’re ensuring you possibly can depend on it, and it will be year-round.

Some Democrats take concern with the broader tax package deal, Home Minority Chief Fentrice Driskell (D-Tampa) says, whereas a gross sales tax for hurricane prep is required, the state must be absolutely funding it.

“It is an train in taking the nice with the dangerous,” stated Driskell. “We completely want a gross sales tax vacation for hurricane preparedness within the space that I symbolize in Tampa Bay, we acquired hit with a few storms very late within the season and it is vital to, I believe, incentivize Floridians to be ready to attempt to reduce, you already know, lack of life, harm to property. And so, I do not know why we’re not funding that.”

Prefer it or not, the change sailed via each chambers and now awaits the governor’s signature.